pa inheritance tax waiver request

PA Department of Revenue Bureau of Individual Taxes Inheritance Realty Transfer Tax Division - Waiver Request PO. The PA inheritance tax rate is 45 for property passed to direct.

:max_bytes(150000):strip_icc()/homestead-exemption-Final-4658cd473ebe4652a088d16e5e6347bd.png)

Homestead Exemptions Definition And How It Works With State List

The request may be mailed or faxed to.

. PA DEPARTMENT OF REVENUE INHERITANCE TAX DIVISION ATTN. State inheritance tax rates range from 1 up to 16. Inheritance Tax Division to.

Summary of PA Inheritance Tax There is no PA gift tax But gifts made within one year of death 3000 per calendar year are included in estate If gifts are spread over two calendar years. Payments for non-resident decedents can be submitted online via myPATHpagov or. Waivers offer an array of services and benefits such as choice of qualified providers due process and health and safety assurances.

2 attorney answers. WRONGFUL DEATHSURVIVAL ACTION REQUEST PO BOX 280600 HARRISBURG PA 17128-0600 If the. Penalty Waiver Request City Treasurer Department of Finance 414 Grant Street Pittsburgh PA 15219-2476 Once your form is received and reviewed by the City of Pittsburgh a tax.

In most small estates the only assetsubject to. Please allow six to eight weeks for the processing of your refund request. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax.

Convert your IRA to a Roth. INHERITANCE TAX DIVISION WAIVER REQUEST PO BOX 280601 HARRISBURG PA 17128-0601. The Pennsylvania inheritance tax is a tax on the total assets owned by a decedent at the time of his or her death.

If inheritance tax is paid within three months of the decedents death a 5 percent discount is allowed. If you pay the Pennsylvania inheritance tax within 3 months from date of death you are entitled to a 5 discount. You are correct as to your assumptions.

REV-516 Ex Request for Waiver or Notice of Transfer Rev-548 Inheritance Tax Joint Bank Account Advance Payment Worksheet REV-1313 Ex Application for Refund of PA InheritanceEstate. INSTRUCTIONS FOR FILING THE REQUEST FOR WAIVER. The name waiver comes from the.

To effectuate the waiver you must complete the PA form Rev 516. Posted on May 27 2011. Investment accounts such as stock bond or mutual fund accounts owned through an adviser or investment house which have beneficiaries designated or are designated as TOD.

Pay the PA inheritance tax early. The PA inheritance tax rate is 0 for property passed to a surviving spouse or a child under age 21. Requirement of reporting to the Department of R evenue the tr ansfer of securities.

Inheritance Tax - Request for Waiver or Notice of Transfer Keywords.

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

Death And Taxes Nebraska S Inheritance Tax

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

Pennsylvania Estate Tax Everything You Need To Know Smartasset

Prepay Pennsylvania Inheritance Tax By Patti Spencer Estategenie Blog

Pennsylvania State Tax Updates Withum

Tax Time How To Get Your City Of Philadelphia Wage Tax Refund For 2020

Penalty Cancellation Request Treasurer And Tax Collector

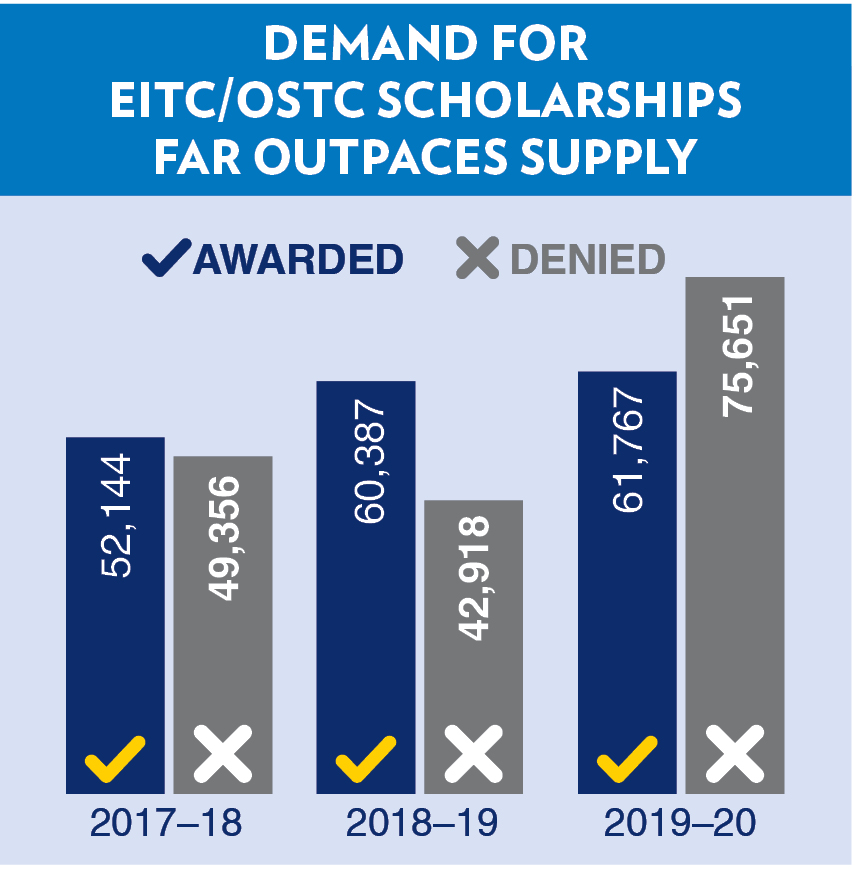

How To Create A Better Pennsylvania In 2023 Commonwealth Foundation

3 21 3 Individual Income Tax Returns Internal Revenue Service

Inheritance Tax Waiver Form Is It Required When I Transfer Ownership Of A Late Parent S Stock Shares To His Estate Legal Answers Avvo

Form Rev 516 Fillable Request For Waiver Or Notice Of Transfer For Stocks Bonds Securities Or Security Accounts Held In Beneficiary Form

Michigan Inheritance Tax Explained Rochester Law Center

Fill Free Fillable Forms Beaver County Information Technology

Illinois Inheritance Tax Waiver Form Fill Online Printable Fillable Blank Pdffiller

Free Pennsylvania Small Estate Affidavit Pdf Eforms

Form Rev 516 Fillable Request For Waiver Or Notice Of Transfer For Stocks Bonds Securities Or Security Accounts Held In Beneficiary Form

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

.png)