oregon statewide transit tax 2021 rate

Taxable base tax rate. Use Revenue Online to file a return make a payment.

Sales Taxes In The United States Wikipedia

Oregon employers are responsible for withholding the new statewide transit tax from employee wages.

. The detailed information for Oregon Transit Tax Rate 2021 is provided. The Oregon Department of. Oregon employers must withhold 01 0001.

The 2017 Oregon Legislature passed House Bill 2017 which included four new taxes that go into effect in 2018. Ezpaycheck How To Handle Oregon Statewide Transit Tax b 500000. Oregon Quarterly Statewide Transit Tax Withholding Return Office use only Page 1 of 1 150-206-003 Rev.

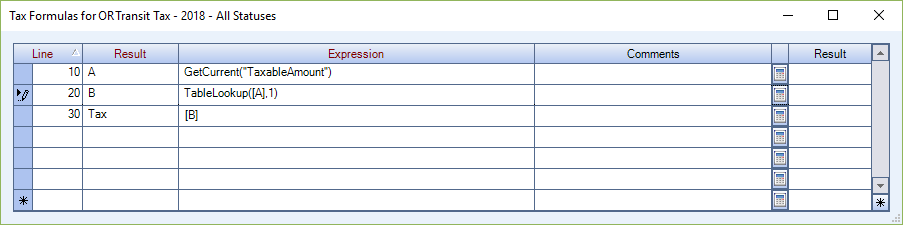

The transit tax will include the following. Formulas and tables. Cigarette and tobacco products tax.

Transient lodging administration page. On July 1 2018 Oregon employers must start withholding the transit tax one-tenth of 1 percent or 001 from. Help users access the login page while offering essential notes during the login process.

Transient lodging administration page. Statewide Transit Tax Statewide Transit Tax Statewide Transit Tax Starting July 1 2018 youll see a new item on your paystub for Oregons statewide transit tax. Beginning with returns filed in January 2021 businesses and payroll service providers will have the ability to file the Statewide Transit Tax returns in bulk.

There is no maximum wage base. This marginal tax rate means. The Oregon transit tax is a statewide payroll tax that employers withhold from employee wages.

Oregon withholding tax tables. Oregon withholding tax tables. This change is effective for calendar year 2019.

24 new employer rate Special payroll tax. Before the official 2022 Oregon income tax rates are released provisional 2022 tax rates are based on Oregons 2021 income tax brackets. The Oregon State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Oregon State Tax Calculator.

Oregon salary tax calculator for the tax year 202122. Cigarette and tobacco products tax. If you make 70000 a year living in the region of Oregon USA you will be taxed 15088.

Your average tax rate is 1198 and your marginal tax rate is 22. See more result See. The tax rate is 010 percent.

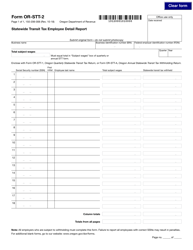

The Oregon Department of Revenue will utilize a subset of the version 52 FSET-standard XML schemas to allow for bulk filing of Form OR-STT1 STT2 and STTA. The only thing you can. Tax rate used in calculating Oregon state tax for year 2021.

Check the box for the quarter in which the statewide. A Statewide transit tax is being implemented for the State of Oregon. Formulas and tables.

The 2022 state personal income tax brackets. Among pages recommended for Oregon Transit Tax Rate 2021 if the not-working page is the official login page it may be because the site is temporarily suspended. The tax is one-tenth.

Current Tax Rate Filing Due Dates. Starting July 1 2018 the tax which is one-tenth of 1 percent or 0001 must be.

What Is The Oregon Transit Tax Statewide Local

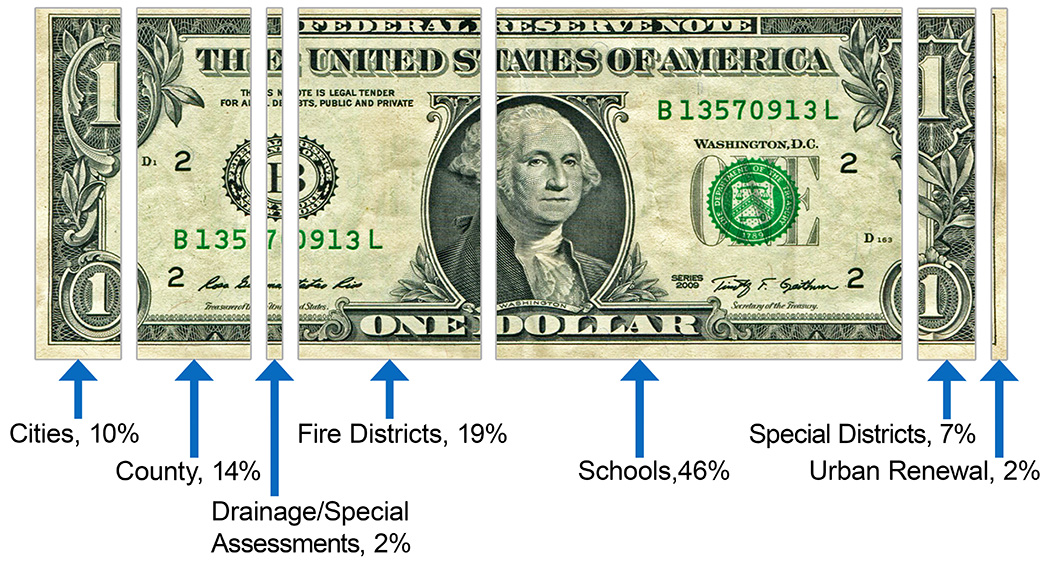

Columbia County Oregon Official Website Tax Office

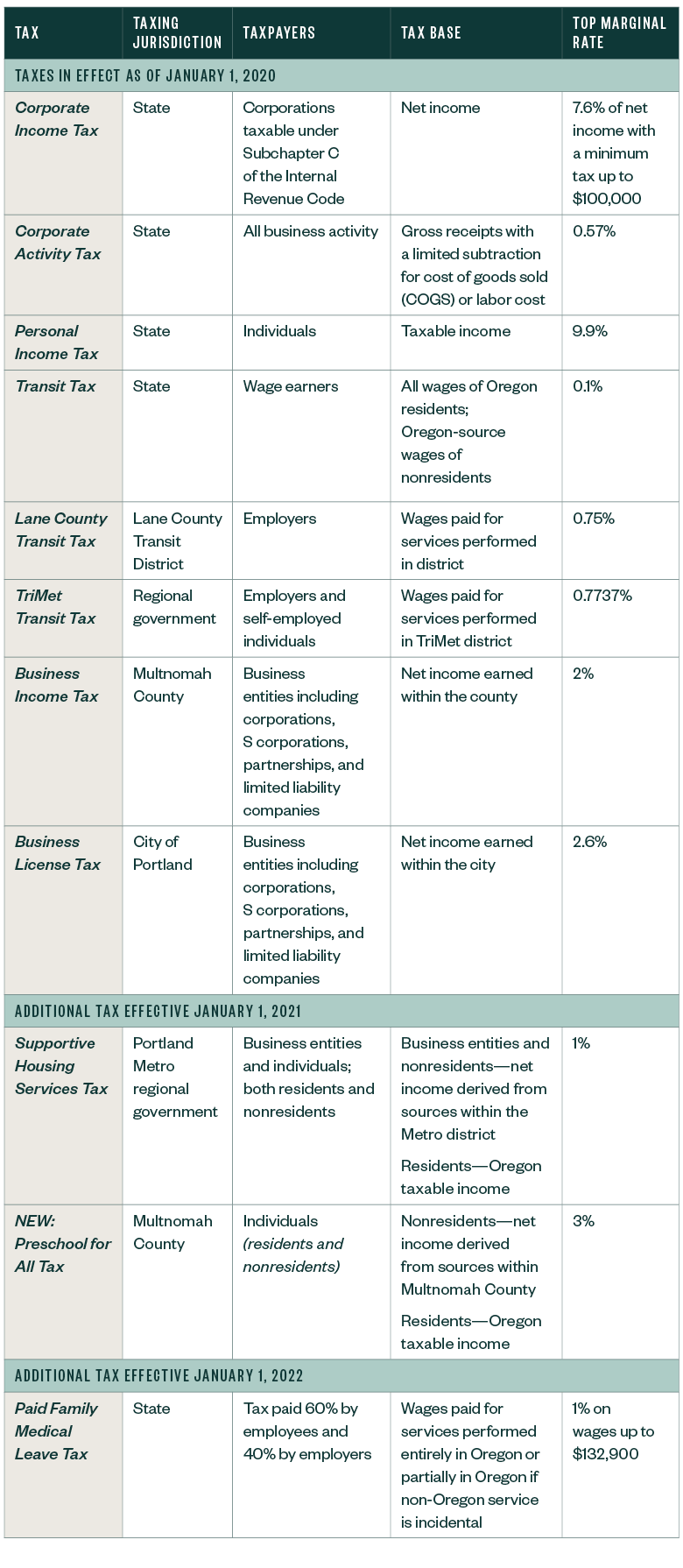

8 Things To Know About Oregon S Tax System Oregon Center For Public Policy

New Portland Tax Further Complicates Tax Landscape

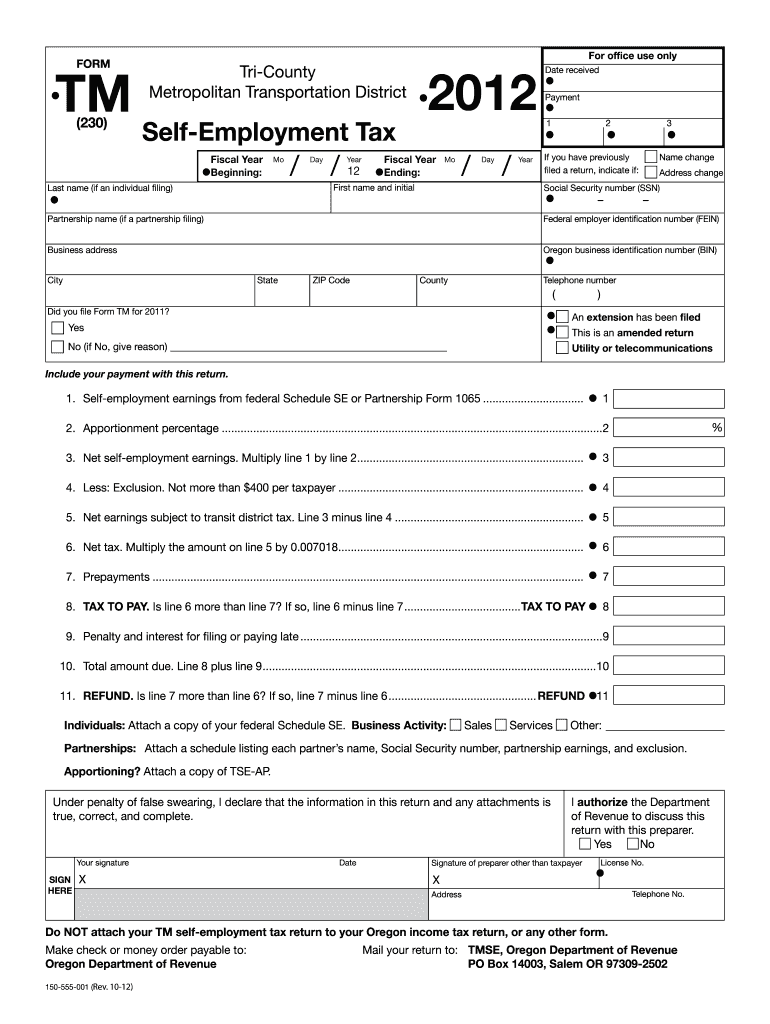

Form Tm And Instructions Trimet Self Employment Tax Fill Out Sign Online Dochub

Oregon Statewide Transit Tax Tax Alert Paylocity

Payroll Systems Attn Oregon Statewide Transit Tax Effective July 1 Payroll Systems

Ezpaycheck How To Handle Oregon Statewide Transit Tax

2021 Payroll In Excel Oregon State Transit Workers Benefit Fund Edition Youtube

Transit Payroll Tax Information City Of Wilsonville Oregon

Oregon Labor Laws The Complete Guide For 2022

Taxes On Unemployment Benefits A State By State Guide Kiplinger

Payroll Systems Attn Oregon Statewide Transit Tax Effective July 1 Payroll Systems

Oregon Department Of Revenue Forms Pdf Templates Download Fill And Print For Free Templateroller